Get the free 4506 c form

Show details

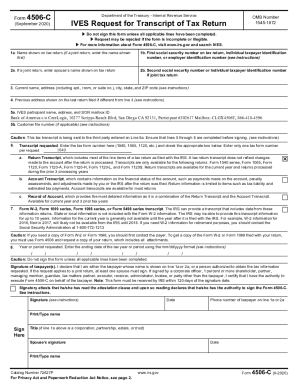

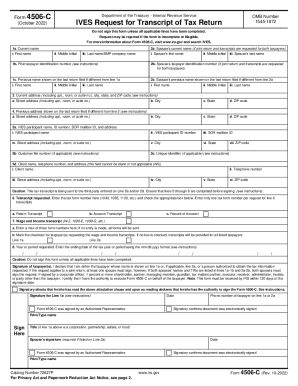

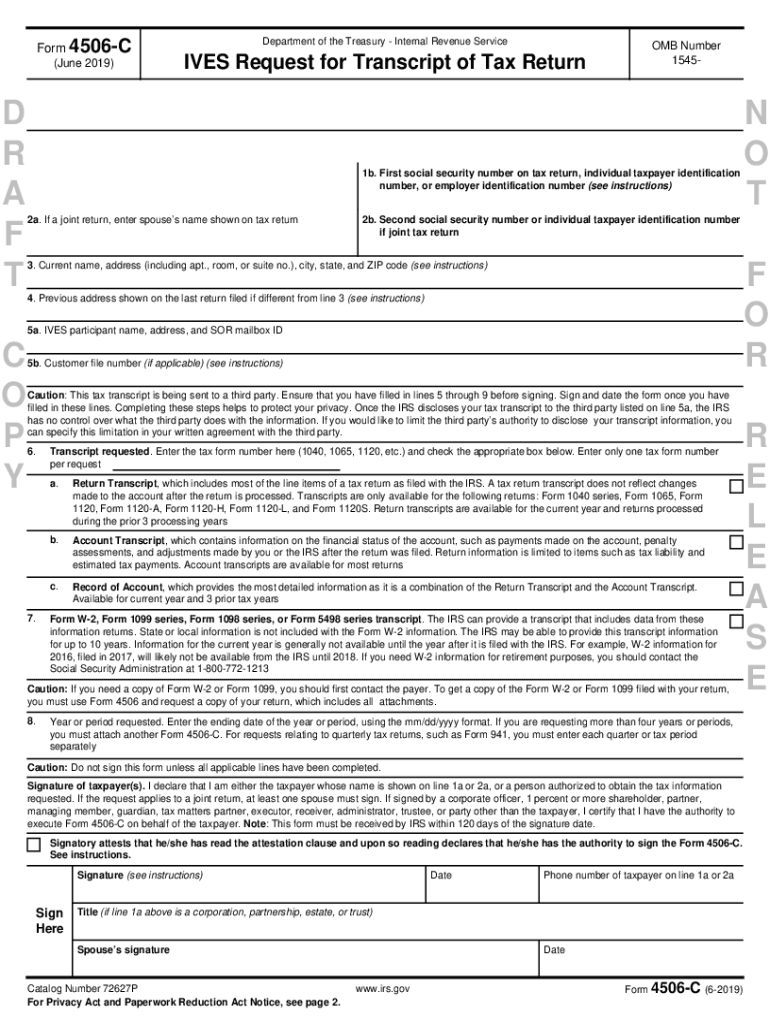

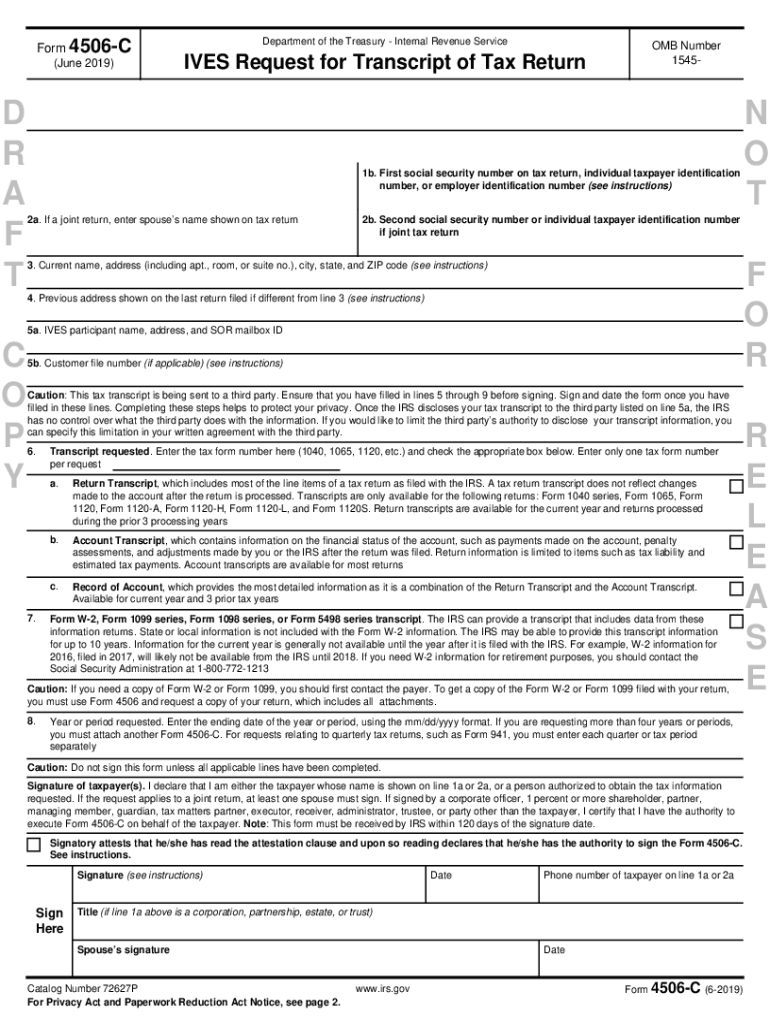

Form 4506C (June 2019’D R A FT Department of the Treasury Internal Revenue Services Request for Transcript of Tax Return OMB Number 1545Do not sign this form unless all applicable lines have been

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 4506 c form

Edit your 4506 c form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4506 c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 4506c online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 4506c. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 4506c form

How to fill out a 4506 c form pdf:

01

The first step is to access the 4506 c form pdf. This can usually be done by downloading it from the IRS website or obtaining it from a tax professional.

02

Once you have the form, open it using a pdf reader or editor.

03

Start by filling in the personal information section. This includes your name, address, social security number, and other identifying details.

04

Next, provide the information of the individual or organization you authorize to receive your tax information. This may be a bank, mortgage lender, or other party.

05

In the following sections, you will need to specify the tax years or periods you want the IRS to release your information for. Be accurate and precise in providing the necessary details.

06

If you are requesting the form for a joint tax return, make sure to include the information of both taxpayers.

07

Check and review your entries for any errors or omissions. Completeness and accuracy are crucial when filling out this form.

08

Once you are satisfied with the information provided, sign and date the form where indicated.

09

Finally, make copies of the completed form for your records and submit the original to the appropriate IRS office as instructed on the form.

10

Make sure to keep a record of the submission for future reference.

Who needs a 4506 c form pdf:

01

Individuals or organizations that require tax information from the IRS for specific tax years or periods.

02

Mortgage lenders, financial institutions, or loan servicers who need to verify a borrower's income and tax information.

03

Tax professionals assisting clients with financial planning, audits, or other tax-related matters.

Fill

irs 4506 c form

: Try Risk Free

People Also Ask about 4506 c fillable form

Do all lenders require 4506-C?

If all borrower income is not validated through the DU validation service, the lender must obtain the completed and signed IRS Form 4506-C.

Why is my credit card company asking for a 4506-C?

It allows the financial institution or credit issuer to look into your IRS tax returns. Most lenders use the form to verify the self-reported income portion of your application to your tax return. American Express and Discover are the two main credit issuers who routinely request Form 4506-T to verify your income.

How to fill out a 4506-C form?

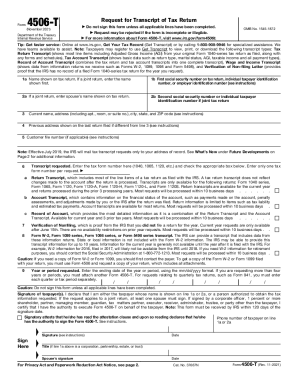

Complete these lines on the form: Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

How fast can a lender get tax transcripts?

It takes up to 10 days to process a request once it is received by the IRS. Tax Return or Tax Account transcripts provide information from the taxpayer's original tax return that loan companies or colleges normally require, eliminating the need for an original tax return.

What is a 4506-C tax form?

Form 4506-C was created to be utilized by authorized IVES participants to order tax transcripts with the consent of the taxpayer. General Instructions. Caution: Do not sign this form unless all applicable lines have been completed.

How long does an Ives request take?

The IRS provides return transcript, W-2 transcript and 1099 transcript information generally within approximately 2-3 business days (business day equals 6 a.m. to 2 p.m. local IVES site time) to a third party with the consent of the taxpayer.

How long does it take to get a 4506?

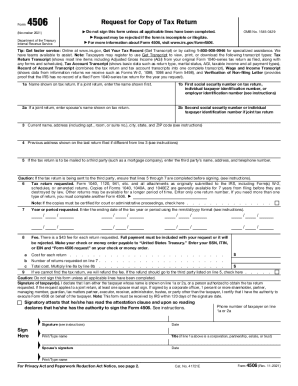

Form 4506-T is free, and transcripts generally arrive in about three weeks. When you file the Form 4506-T, you'll receive a printout of most of the line items on your tax return (rather than a copy of the actual return). This document is called a tax return transcript.

How do you fill out a 4506-C form?

Complete these lines on the form: Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

How long does it take IRS to verify income?

(added March 14, 2022) After you verify your identity and tax return information using this service, it may take up to nine weeks to complete the processing of the return.

What is a 4506-C form for?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

What is 4506-C used for?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

Why is discover asking for a 4506-C?

It allows the financial institution or credit issuer to look into your IRS tax returns. Most lenders use the form to verify the self-reported income portion of your application to your tax return. American Express and Discover are the two main credit issuers who routinely request Form 4506-T to verify your income.

Why would a credit card company request a 4506-C?

It allows the financial institution or credit issuer to look into your IRS tax returns. Most lenders use the form to verify the self-reported income portion of your application to your tax return. American Express and Discover are the two main credit issuers who routinely request Form 4506-T to verify your income.

How long does it take to get a 4506-C back from the IRS?

4506 can take the IRS up to 60 days to complete. The IRS Form 4506-T is used to request tax transcripts directly from the IRS.

What is the purpose of 4506-C?

Purpose of form. Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

How long does it take to process a 4506-C?

The IRS Form 4506 is used to retrieve photo copies of the tax returns that were filed by the taxpayer. 4506 can take the IRS up to 60 days to complete. The IRS Form 4506-T is used to request tax transcripts directly from the IRS.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete discover irs consent form 4506 c online?

Filling out and eSigning what is form 4506 c is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the irs form 4506 c pdf form on my smartphone?

Use the pdfFiller mobile app to fill out and sign irs form 4506 c on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out what is a 4506 c on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your what is 4506 c form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is 4506 c form pdf?

The 4506-C form is a document used by taxpayers in the United States to request a copy of their tax return information from the Internal Revenue Service (IRS). It is a version of the standard 4506 form, specifically designed to authorize third parties, like lenders or financial institutions, to obtain the taxpayer's return information.

Who is required to file 4506 c form pdf?

Individuals or businesses who need to provide tax return information to third parties, such as lenders for mortgage applications or other financial purposes, are required to file the 4506-C form.

How to fill out 4506 c form pdf?

To fill out the 4506-C form, the taxpayer must provide their name, Social Security number or Employer Identification Number (EIN), address, and the tax years for which they are requesting information. They should also include the name and address of the third party receiving the information and sign the form to authorize the request.

What is the purpose of 4506 c form pdf?

The purpose of the 4506-C form is to allow taxpayers to authorize the IRS to release their tax return information to a designated third party, facilitating processes such as loan applications, audits, and verifying income.

What information must be reported on 4506 c form pdf?

Information required on the 4506-C form includes the taxpayer's name, Social Security number or EIN, address, the third party's name and address, the specific tax years needed, and the taxpayer's signature to authorize the release of their tax information.

Fill out your 4506 c form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank 4506 C Form is not the form you're looking for?Search for another form here.

Keywords relevant to 4506 c forms

Related to what is form 4506c

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.